What is Exness Social Trading?

Social Trading for dummies

It is very likely that you have already heard of Social Trading. It is not something innovative in the sector. Sometimes it is also called copy trading or mirror trading. With this, if you still have doubts about what it really is and if Social Trading is safe, we are going to explain it in detail with a focus on Exness Social Trading account.

The principles of Social Trading

In two words, Social Trading is an operation technique that involves an investor watching the operations of other traders (usually much more experienced or professionals) and copying what they do to get the same amount of profits. The traders whose operations are copied, in turn, receive a commission, if their “followers” obtain profits. Although it may seem somewhat complicated, in reality everything is done automatically, thanks to the platform or application such as Exness.

As you can see, in Social Trading both parties win. The investor can start trading and earning before they gain enough experience in trading and also learn from the practice of the best experts. And the trader who is being imitated (the strategy provider) and who is always interested in their strategies being effective, has the opportunity to earn a little extra thanks to the commission they set themselves (up to 50%).

What is the difference between Exness Social Trading and manual trading?

In the case of manual trading, the operator must do everything themselves: monitor the market, devise a strategy, implement it, and monitor its performance. And Social Trading allows you to get rid of all these hassles. Compared to manual, social is much more suitable for beginners, as it requires less experience and effort.

How does Exness Social Trading work?

If you are looking for Social Trading platforms, take a look at Exness. This is a broker that, apart from accounts for manual trading, also offers a Social Trading application. So, if you are interested in this opportunity, we are going to explain how everything works in detail.

If you are a novice investor and want to try copy trading, you should download the Exness application from Google Play Market or App Store and register an account with your email address, password, and phone number. Once your identity is verified, you will be able to log in and review the available strategies. If you already have an existing Exness account, you can skip the registration step and log in right after the app is installed.

In turn, the experienced trader must first register on the Exness website. After doing so and logging into the account, they will be able to start creating strategies under the Social Trading tab of the personal area. Once created, each strategy will become visible to investors through the app. And every time someone copies it, all the operations that the trader carries out in an account of this strategy will be copied in the client’s investment according to the copy coefficient.

What is it and how is the copy coefficient calculated in Exness Social Trading?

Because strategy providers and investors operate with different volumes, to calculate the ratio, Exness introduced the so-called copy coefficient.

This is the approximate relationship between the capital of the strategy and the investments of the traders who copy it. When calculating the coefficient, the system also takes into account if the strategy has active open orders when the investor copies it.

The formula for calculating the coefficient is: capital in the investment account of the trader who copies the strategy / (capital in the strategy account that belongs to the provider + sum (total spread cost at the time of copying)). As for the total spread cost, it will be 0, in the case that the strategy does not have open orders when the investor copies it.

What is it and how is a trading period calculated?

In order to assess the profitability of a strategy within a specified period of time and correctly calculate the trader’s commission, Exness has established a one calendar month operating period that ends on the last Friday of the month.

What is the Social Trading commission?

The Social Trading commission is the “price” of a profitable strategy. That is, it is a commission percentage that the investor must pay to the provider for the profits obtained from the copied strategies. Exness allows providers to set and change the commission percentage in their Personal Area.

The commission is credited to the special account called Social Trading commission account, which is automatically opened in the strategy provider’s Personal Area. Once the funds are credited, the trader can use them to make operations, withdraw them, or even transfer them to other accounts.

Exness Account Types Social Trading and its conditions

In their Personal Area, strategy providers can choose between 2 types of Social Trading accounts: Social Standard and Social Pro. Both allow trading with Forex currency pairs, metals, and cryptocurrencies through the MT4 platform. Other features that the accounts have in common are:

- the minimum strategy deposit of 500 USD;

- the minimum trading volume per order of 0.01 lots;

- 0% Stop Out;

- the commission from 0% to 50%;

- the leverage of 1:50, 1:100 or 1:200 when creating a strategy and of 1:2, 1:10, 1:20, 1:50, 1:88, 1:100 or 1:200 when editing it;

- the account currency – US dollars.

In other aspects, Social Standard and Social Pros are different:

| Social Standard | Social Pro | |

|---|---|---|

| Minimum strategy capital | 100 USD | 400 USD |

| Spreads | from 0.3 pips | from 0.1 pips |

| Execution type | Market | from 0.1 pips |

| Margin Call | 60% | 30% |

Strategies of Social Trading

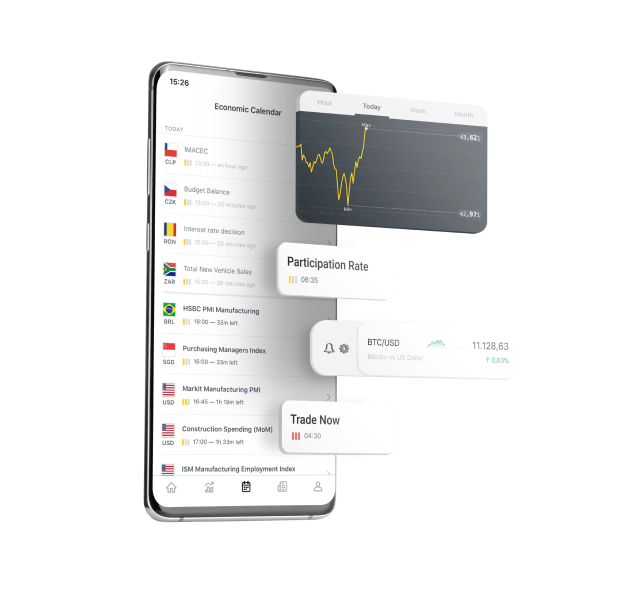

Exness has more than 40,000 active clients per month. And most of them are experienced traders. So, if you choose the Exness Social Trading platform, you will be able to choose from many quality strategies to copy. We all know that the number one investment rule is to never put all the eggs in the same basket. Exness knows this too and, therefore, offers investors a wide range of trading strategies with Forex currencies, cryptocurrencies, and metals. In addition, understanding that each trader chooses strategies based on different factors, Exness added 6 different filters to its social trading application:

- The most copied strategies;

- Most wins in 1 month;

- Strategies with low commission;

- Strategies with moderate risk;

- Strategies with moderate risk;

- New strategies.

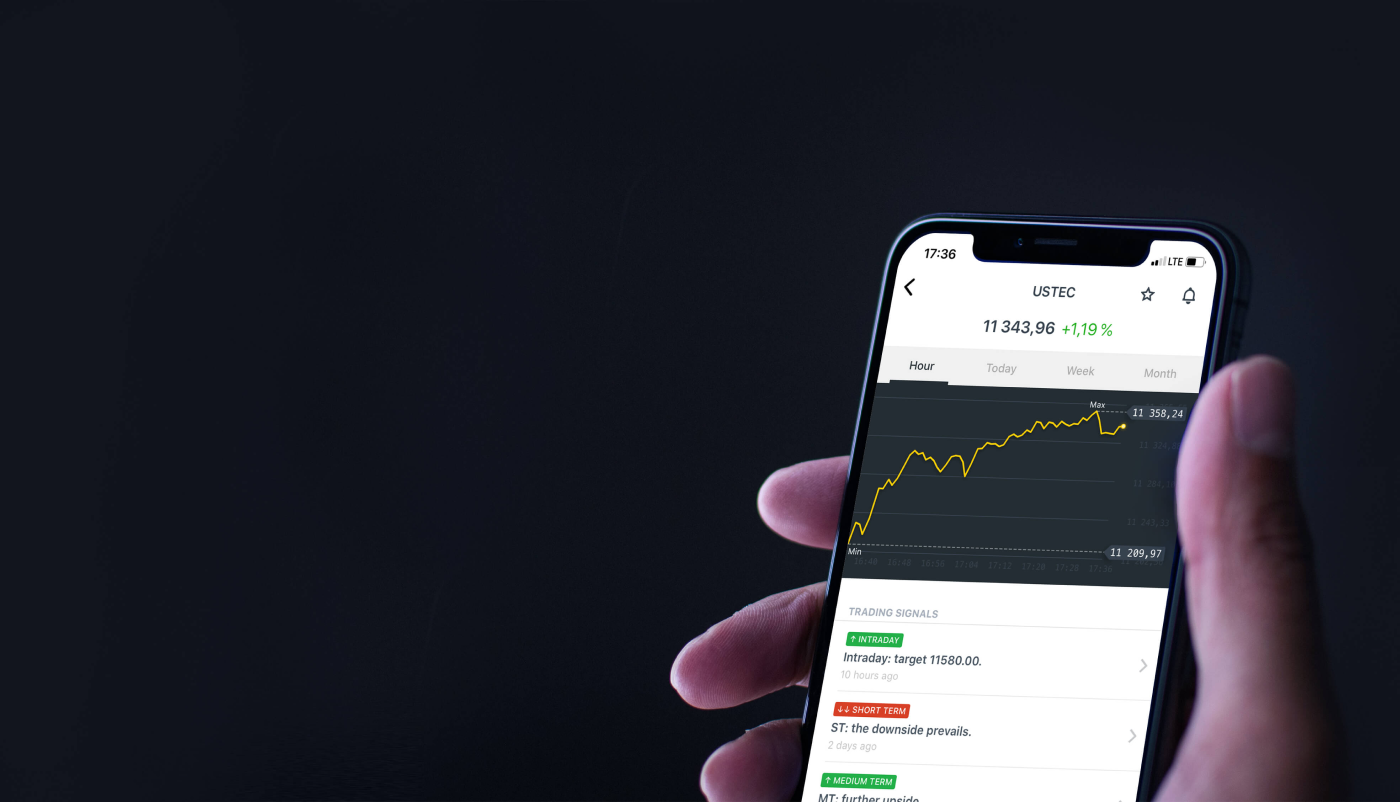

What kind of information about a strategy can be found in the app?

In the Exness Social Trading application, all the necessary information is presented so that you can make the decision whether it is worth copying one strategy or another. Specifically, under the Overview / Summary tab, you can consult the risk level, performance, commission, leverage, the number of investors following the strategy, the capital, the general information about the strategy provider and the period of operations. Don’t know what all those terms mean? Don’t worry, we will explain them one by one!

First, pay attention to the risk level. It can vary from moderate from 1-5 to high from 6-8 and very high from 9-10 points. In this case, everything is obvious, the higher the number, the greater the risk you assume, if you copy the strategy. And the greater the risk, the greater the possibility that everything results in the loss of investments.

Another important factor is the strategy’s performance. It is presented in the form of a chart of the evolution of capital over the month that is updated every 5 minutes. Apart from this, it should be mentioned that it is calculated in such a way that it is not affected by the withdrawals or deposits made by the provider. This allows avoiding artificial evolution. The commission is the percentage that you should pay the trader once the investment brings you profits. Leverage represents the relationship between the funds of the trader who provides the strategy and the funds borrowed by the investors. The level of leverage does not influence the risk level, but it does influence exposure to the markets.

- Under Capital, the total value that the account would have (in a specific currency) is understood, if all positions were closed.

- As for the operation period, we have already explained what it is before. The only thing worth mentioning is that it ends on the last Friday of the month.

- And when clicking Start copying, you will be asked to enter an investment to your liking, but not less than the minimum established by the provider.

- We also recommend that you consult the description to better understand the idea behind the strategy.

- So, the Exness Social Trading platform provides you with a good opportunity to try many new strategies regardless of whether you have experience in trading or not. Any existing Exness client can start using the application, by logging in with the credentials of their account registered on the website, and try both creating and copying strategies.

Frequently Asked Questions

What is Exness’ Social Trading system?

Exness Social Trading is a platform that allows professional traders to share experience and earn commissions for their profitable strategies, and beginners – to learn from the best experts and earn profits much more easily without even having deep knowledge of operations.

Are there accounts without swap in Exness Social Trading?

Yes, you can find these strategies in the Exness Social Trading application. What you should do is log into the app, open the Strategies tab and set the filters to only show the no-swap options.

Is it possible to link a regular Exness account with the Exness Social Trading account?

If you registered your Social Trading account using the same email address that you used to open an Exness trading account, they are already linked. The system automatically links them. So, you can enter your Social Trading account login details to log into the Exness Personal Area. And if you used different email addresses to register those accounts, unfortunately, they cannot be linked.

Why is Exness Social Trading safe?

Because the Exness company is absolutely reliable, as it is regulated by the FCA (Financial Conduct Authority), the number one Forex regulator in the UK, and CySEC (Cyprus Securities and Exchange Commission), another reputable regulator in Europe.