Exness Deposit

Exness offers its users an array of financial instruments and user-friendly trading experiences. Central to its operation and fundamental to every trader’s journey is the process of funding an account, commonly referred to as making a deposit. Understanding Exness deposit methods is crucial for traders aiming to manage their funds effectively and leverage trading opportunities timely.

Depositing funds into your Exness account is the first step toward engaging in forex trading and accessing the vast opportunities available in the financial markets. The platform caters to a diverse clientele, offering various deposit methods to accommodate traders’ preferences worldwide.

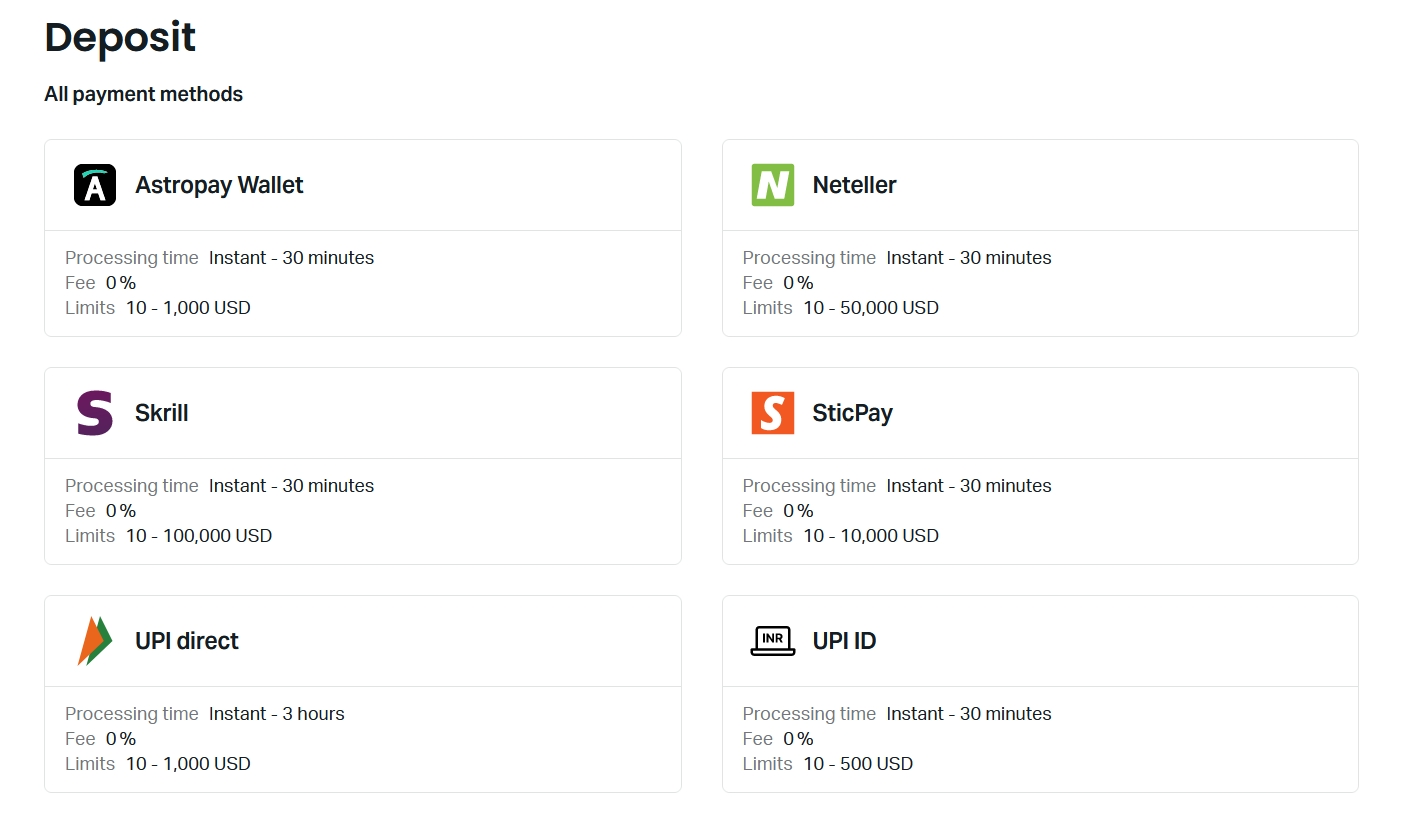

Deposit Methods at Exness

Deposit methods at Exness are designed to cater to a wide range of preferences, ensuring that traders around the world have efficient and convenient options to fund their accounts. Here, we’ll delve into the various deposit methods available at Exness, highlighting their key features and how traders can utilize them:

Bank Wire Transfer:

- Bank transfers are a traditional and reliable method for depositing funds into your Exness account.

- It involves transferring money directly from your bank account to your Exness trading account.

- While secure, this method may take several business days to process.

Credit/Debit Cards:

- Exness accepts major credit and debit cards, including Visa and MasterCard.

- This method offers a quick and easy way to deposit funds, with transactions often processed instantly.

- Traders need to ensure their cards are cleared for international transactions if they are trading from different jurisdictions.

Electronic Payment Systems:

- E-wallets and online payment systems like Neteller, Skrill, and WebMoney are available for deposits.

- These methods provide rapid processing times, allowing traders to access their funds quickly.

- They are particularly popular for their convenience and reduced processing times compared to more traditional methods.

Cryptocurrencies:

- Exness has adapted to the growing trend of cryptocurrency by accepting deposits in various digital currencies.

- Crypto deposits can be advantageous due to their low processing fees and quick transaction times.

- Traders should be aware of the market volatility and how it might affect the value of their deposited funds.

Local Bank Transfers and Local Payment Methods:

- In certain regions, Exness offers local bank transfer options, allowing traders to deposit funds directly from their local banks.

- Additionally, specific local payment methods tailored to individual countries may be available, offering greater convenience for traders in those locations.

Exness Wallet:

- The Exness Wallet is a central hub for managing funds, making it easier to transfer between accounts or handle withdrawals and deposits efficiently.

- Traders can deposit funds into their Exness Wallet and distribute the funds across their trading accounts as needed.

Each deposit method comes with its own set of benefits and considerations, such as processing times, fees, and availability in certain regions. Traders should choose the method that best suits their needs, considering factors like speed, convenience, and cost. Always ensure to review the terms and conditions associated with each deposit method on the Exness platform to make informed decisions and optimize your trading experience.

How to Make a Deposit at Exness

To deposit funds into your Exness trading account, follow these simple steps:

- Log into Your Exness Account: Start by logging into your Exness account. If you don’t have an account yet, you’ll need to sign up for one on their website.

- Navigate to the Deposit Section: Once logged in, navigate to the “Deposit” section of your account. This is usually located in the top menu or sidebar of the platform.

- Select Deposit Method: Exness offers a variety of deposit methods, including bank transfer, credit/debit cards, electronic payment systems like Skrill, Neteller, Perfect Money, and many more. Choose the method that is most convenient for you.

- Enter Deposit Amount: After selecting your preferred deposit method, enter the amount you wish to deposit. Make sure to double-check this amount to avoid any mistakes.

- Follow the Instructions: Depending on the method you chose, you’ll be directed to follow specific instructions. For bank transfers, you’ll likely need to provide Exness’ banking details. For credit/debit cards, you’ll enter your card information. Electronic payment systems will require you to log into your account with that service.

- Confirm the Transaction: After providing the necessary details, you’ll be asked to confirm the transaction. Double-check all the information to ensure accuracy.

- Wait for Confirmation: Once you confirm the deposit, you’ll usually receive a confirmation message or email from Exness. The time it takes for the deposit to reflect in your trading account can vary based on the method you used.

- Start Trading: After the deposit is successfully processed, you should see the funds in your Exness trading account. You are now ready to start trading!

Exness Deposit Limits and Fees

Exness offers competitive conditions when it comes to deposit limits and fees, ensuring that traders can manage their finances effectively while using the platform. Understanding the deposit limits and any associated fees is crucial for effective capital management and strategic planning. Here’s an overview of Exness’s deposit limits and fees:

Deposit Limits

Minimum Deposit:

- The minimum deposit amount at Exness can vary depending on the account type and deposit method. It is generally low, designed to cater to traders of all levels, including beginners.

- For example, some account types may have minimum deposits as low as $1 or equivalent in another currency, although this can vary based on the selected payment method or account type.

Maximum Deposit:

- Maximum deposit limits can also vary depending on the chosen deposit method. Some methods may not have a maximum limit, allowing for significant flexibility for larger traders or institutional accounts.

- It’s essential to check the specific limits for each deposit method in the personal area on the Exness platform, as these can vary based on the trader’s country of residence and the chosen payment method.

Deposit Fees

Exness Deposit Fees:

- Exness prides itself on offering free deposits for most payment methods, meaning the platform does not charge any fees for funding your account.

- However, it’s always advisable to verify the fee structure for your specific deposit method, as policies can change.

Third-party Fees:

- While Exness might not charge for deposits, it’s important to be aware that some payment methods or financial institutions may impose their own fees or service charges.

- For example, banks might charge a transaction fee for wire transfers, or there might be fees associated with currency conversion if your deposit currency differs from your bank account’s currency.

Currency Conversion:

- If you’re depositing in a currency different from your trading account’s currency, a conversion might be necessary. In such cases, be mindful of the exchange rates and any potential conversion fees that could affect the amount credited to your trading account.

Checking Deposit Conditions

- Always refer to the Exness personal area or contact customer support for the most current and specific information regarding deposit limits and fees for your account.

- It’s beneficial to review the terms regularly, as changes in payment providers or platform policies can alter these conditions.

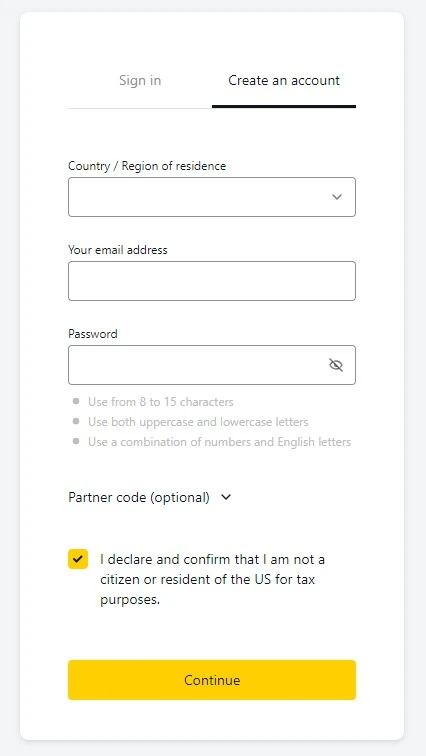

Exness Account Registration and Verification

Before making your deposit, registering and verifying an account with Exness is straightforward, ensuring a secure and personalized trading experience. Here’s a guide to get you started.

Account Registration

- Visit the Exness Website: Go to the Exness official website and locate the registration or sign-up section.

- Provide Personal Information: Fill out the registration form with your personal details, including your name, email address, and phone number. Ensure the information is accurate and matches your official documents, as this will be necessary for the verification process.

- Choose Your Account Type: Exness offers different types of accounts tailored to various trading styles and experiences. Select the one that best fits your trading strategy and experience level.

- Set Up Your Trading Platform: Choose the trading platform you prefer, such as MetaTrader 4 or MetaTrader 5. Download and install the necessary software or opt for the web-based version if available.

- Agree to Terms and Conditions: Review the terms, conditions, and privacy policy of Exness. Agree to them after ensuring you understand all the stipulations involved.

- Account Activation: Upon completing the registration, you’ll typically receive an email with an activation link or code. Follow the instructions to activate your account.

Account Verification

- Login and Access the Verification Section: Once your account is activated, login and navigate to the account verification section.

- Identity Verification: Upload a clear and valid government-issued identification document, such as a passport or an ID card. Ensure that the document is valid and all details are legible.

- Address Verification: Provide a recent utility bill or bank statement that includes your name and current address. The document should be no more than three months old and should clearly show the issuer’s name and your address.

- Additional Verification (if required): Depending on your region or as per Exness’s compliance requirements, you might be asked to provide additional documentation or information.

- Verification Process: Once you submit all required documents, Exness will review them for verification. The process typically takes a few business days, although it might vary based on the volume of applications or document clarity.

- Completion: You will receive a notification once your account has been verified. After verification, you can proceed to deposit funds and start trading.

Conclusion

Exness provides a user-friendly platform with diverse deposit methods, catering to global traders’ needs. From bank transfers to cryptocurrencies, Exness ensures convenient funding. The platform’s transparency in deposit limits and fees, including low thresholds and minimal charges, makes forex trading accessible to all. Traders should review deposit conditions for informed decisions, ensuring effective account management and trading strategy planning within Exness’ secure and reliable environment.

FAQs for Exness Deposit

What deposit methods can I use with Exness?

You can use various deposit methods including bank wire transfers, credit/debit cards, electronic payment systems (such as Neteller, Skrill, and WebMoney), and cryptocurrencies. The availability of these methods may vary based on your location.

Are there any fees for depositing into my Exness account?

Exness does not charge any fees for most deposit methods. However, it’s crucial to be aware that some payment systems or banks might impose their own transaction fees. Always verify with your selected payment provider.

What is the minimum deposit amount required by Exness?

The minimum deposit amount at Exness can be as low as $1, depending on the account type and deposit method chosen. However, this amount may vary, so it’s recommended to check the specific requirements for your selected deposit method and account type.

How long do deposits take to be processed in my Exness account?

Deposit times vary depending on the method used. Many electronic payment methods and credit/debit card deposits are processed instantly, while bank wire transfers can take several business days.

Can I deposit funds in a currency different from my account currency?

Yes, you can deposit funds in a different currency. Exness will automatically convert the funds to your account’s currency, although you should be aware of potential conversion fees and exchange rate fluctuations.

How can I check the status of my deposit?

You can check the status of your deposit in your personal area on the Exness website. If you encounter any issues or delays, you should contact Exness customer support for assistance.